- At its Capital Markets Day, Lonza outlined strategic priorities and innovation highlights with a clear focus on sustainable value creation

- Accelerated, de-risked, long-term investment program will drive sustainable business growth

- 2021 CAPEX anticipated at around 25% of sales, and remain elevated at current levels for the next few years, returning to high-teens by 2025

- 2024 Group Guidance: low-teens CER sales growth, CORE EBITDA margin of around 33% to 35% and double-digit ROIC

Basel, Switzerland, 12 October 2021 – At its Capital Markets Day hosted today, Lonza provided more details of the company’s strategic priorities at a Group and divisional level. The following key priorities support the company's continuing commitment to sustainable value creation:

- A de-risked long-term investment program

- Operational excellence to deliver customer value

- Differentiation through ongoing innovation

- Updated commitments to advance sustainability

- Ambitious recruitment and talent management

The favorable market dynamics across Lonza's businesses create attractive investment opportunities, reflected in the company's growth plans. Lonza is accelerating its de-risked long-term investment program to ensure it can capture increasing market demand and capitalize on future opportunities. These investments will allow Lonza to drive strong growth in the mid-to-long term. The company anticipates 2021 Full-Year CAPEX to reach around 25% of sales and remain elevated at current levels for the next few years, returning to high-teens by 2025.

During today's event, Lonza also outlined each division’s strategic and innovation priorities. All Divisions are growing ahead of their reference markets, building on growth investments and innovation. The Biologics division remains the primary driver for growth with an increased focus on innovations across all businesses. Innovation priorities include next-generation modalities, manufacturing optimization and automation.

Driven by strong momentum across businesses, Lonza has updated its 2024 Group and divisional Mid-Term Guidance. At a Group level, the company anticipates:

- Low-teens CER sales growth

- CORE EBITDA margin of around 33% to 35%

- Double-digit ROIC, reflecting positive sales growth and increased investments

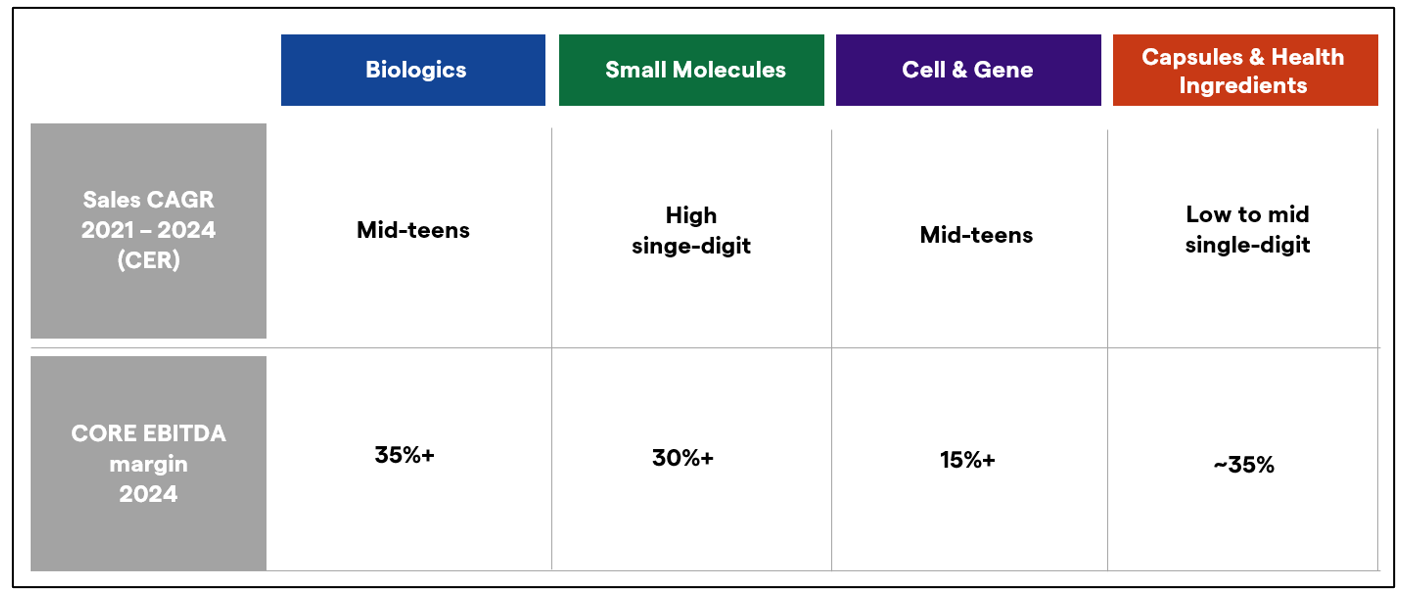

At a divisional level, Lonza updated its Guidance as follows:

The 2021 Capital Markets Day was hosted by Pierre-Alain Ruffieux, CEO, Lonza. He commented:

"2021 has been a significant year for Lonza. We have strengthened our strategic focus, refined our business model and demonstrated our resilience and agility. We have entered a new chapter as a pure-play partner to the healthcare industry while redoubling our focus on long-term growth.

"Our ambitious investment plans are underpinned by our strong pipeline, attractive market momentum and our proven ability to deliver for our customers. With these investments, we are paving the way to deliver strong growth in the mid-to-long term, which will further strengthen our leading industry position and create value for our stakeholders. We are taking the next steps on our journey of continued and sustainable business growth."

Lonza’s CEO, Pierre-Alain Ruffieux, was joined by the current CFO, Rodolfo Savitzky, and the incoming CFO, Philippe Deecke (whose tenure will commence in December 2021).

Please click here to download the Capital Markets Day Presentation.